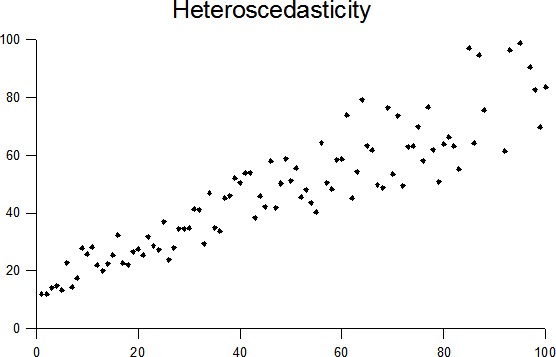

Heteroscedasticity

In statistics, a sequence or a vector of random variables is heteroscedastic if the random variables have different variances. The complementary concept is called homoscedasticity. (Note: The alternative spelling homo- or heteroskedasticity is equally correct and is also used frequently.) The term means "differing variance" and comes from the Greek "hetero" ('different') and "skedasis" ('dispersion').

When using some statistical techniques, such as ordinary least squares (OLS), a number of assumptions are typically made. One of these is that the error term has a constant variance. This will be true if the observations of the error term are assumed to be drawn from identical distributions. Heteroscedasticity is a violation of this assumption. For example, the error term could vary or increase with each observation, something that is often the case with cross-sectional or time series measurements.

Consequences

Heteroskedasticity does not cause OLS coefficient estimates to be biased. However, the variance (and, thus, standard errors) of the coefficients tends to be underestimated, inflating t-scores and sometimes making insignificant variables appear to be statistically significant.

Detection

There are several methods to test for the presence of heteroscedasticity:

- Park test

- Glejser test (1969)

- White test

- Breusch-Pagan test

- Goldfeld-Quandt test

- Cook- Weisberg test

Fixes

There are two common corrections for heteroscedasticity:

- Use a different specification for the model (different X variables, or perhaps non-linear transformations of the X variables).

- Apply a weighted least squares estimation method, in which OLS is applied to transformed or weighted values of X and Y. The weights vary over observations, depending on the changing error variances.

Examples

Heteroscedasticity often occurs when there is a large difference among the sizes of the observations.

- The classic example of heteroscedasticity is that of income versus food consumption. As one's income increases, the variability of food consumption will increase. A poorer person will spend a rather constant amount by always eating fast food; a wealthier person may occasionally buy fast food and other times eat an expensive meal. Those with higher incomes display a greater variability of food consumption.

- Imagine you are watching a rocket take off nearby and measuring the distance it has traveled once each second. In the first couple of seconds your measurements may be accurate to the nearest centimeter, say. However, 5 minutes later as the rocket recedes into space, the accuracy of your measurements may only be good to 100 m, because of the increased distance, atmospheric distortion and a variety of other factors. The data you collect would exhibit heteroscedasticity.

See also

- Kurtosis (peakedness)

- Breusch-Pagan test of heteroskedasticity of the residuals of a linear regression

- Regression analysis

- Homoscedasticity

- Autoregressive conditional heteroskedasticity (ARCH)

- White test

References

Most statistics textbooks will include at least some material on heteroscedasticity. Some examples are:

- Studenmund, A.H. Using Econometrics 2nd Ed. ISBN 0-673-52125-7. (devotes a chapter to heteroskedasticity).

- Verbeek, Marno (2004): A Guide to Modern Econometrics, 2. ed., Chichester: John Wiley & Sons, 2004, pages

- Greene, W.H. (1993), Econometric Analysis, Prentice-Hall, ISBN 0-13-013297-7, an introductory but thorough general text, considered the standard for a pre-doctorate university Econometrics course;

- Hamilton, J.D. (1994), Time Series Analysis, Princeton University Press ISBN 0-691-04289-6, the text of reference for historical series analysis; it contains an introduction to ARCH models.

Special subjects:

- Glejser test: Furno, Marilena (Universita di Cassino, Italy, 2005): The Glejser Test and the Median Regression, in: Sankhya - The Indian Journal of Statistics, Special Issue on Quantile Regression and Related Methods, 2005, Volume 67, Part 2, pp 335-358 : http://sankhya.isical.ac.in/search/67_2/2005015.pdf

- White test: White, Halbert (1980): A Heteroscedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroscedasticity, in: Econometrica, Vol. 48, 1980, page 817-838

- Heteroskedasticity in QSAR Modeling: http://www.qsarworld.com/qsar-statistics-heteroscedasticity.php

de:Homoskedastizität und Heteroskedastizität el:Ετεροσκεδαστικότητα it:Eteroschedasticità fi:Heteroskedastisuus